Summer

2018 Swiss GDP data update: like no other before |

|||||

|---|---|---|---|---|---|

The seco data revision, its reason

and its impact on GDP nowcasting |

|||||

| «home | © Christian Müller 2018 | ||||

| the gap | Early last year a gap emerged between the «KOF surprise

indicator»

and the year-on-year growth rate of Swiss GDP published by the State

Secretariat for Economic Affairs (seco). A gap of that size and

duration has never been observed since the indicator's introduction in

2007. While the indicator signaled a significant expansion of the

Swiss economy, official estimates by the seco saw GDP hover around the

one percent mark only. |

||||

| The

figure below - first

published in February this year -

illustrates the puzzling difference between the indicator's information

and the seco data. The blue bars represent the official seco

year-on-year GDP growth rate and the green line the indicator

values as of February 2018. Obviously, while the indicator picks up at

the end of the sample, reported GDP growth remained stubbornly weak. |

|||||

|

|||||

| Based on the clear signals sent by the «KOF surprise indicator» the first estimate for 2017 GDP growth amounted to 1.4 percent, which is just 0.2 percentage points short of the latest data release. These most recent GDP figures for 2017 are owed to the Federal Statistical Office's (FSO) first estimate of Swiss GDP published at the end of August. Consequently, the 2017 growth rate has been revised by no less than 0.5 percentage point, and hence by more than ever before in more than ten years. | |||||

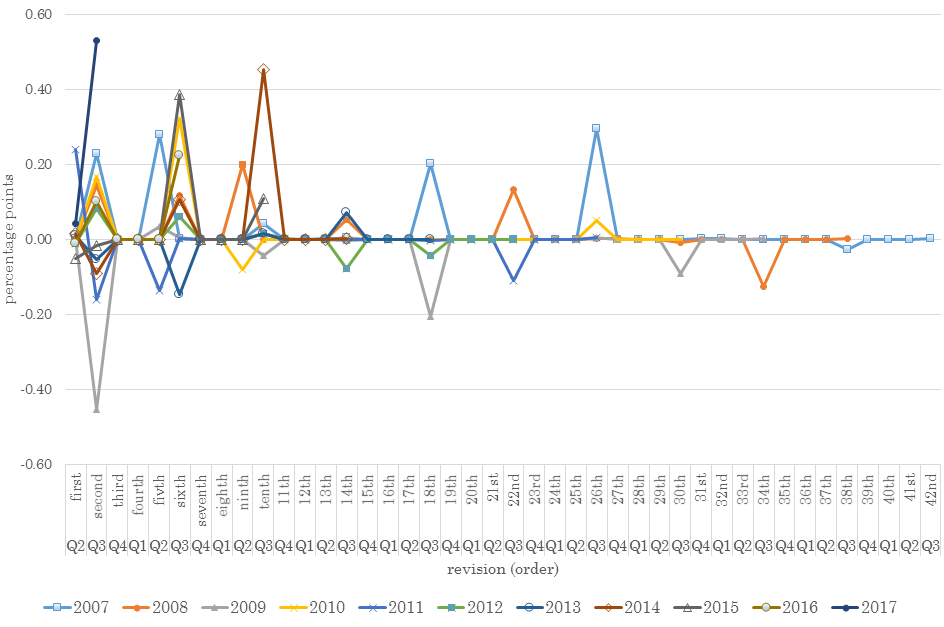

| exceptional | The following graph compares all revisions of annual growth rates for Swiss GDP by the order of occurrance. The latest revision of the 2017 rate is the second revision since the initial release by seco in March 2018. Accordingly, the first revision was made in May this year when the estimated growth rate did not change as seems to have been the case for all first revisions in general. | ||||

| Apparently, the summer 2018 revision really stands out. It even outweighs the revision of the 2009 crisis year's growth estimate in absolute terms. | |||||

|

|||||

| This exceptional correction of preliminary data raises a number of questions such as what has caused the revision, what the implications for indicator-based nowcasting are and, finally, what could be done in order to avoid errors of this size. | |||||

| deflator troubles |

The

first of these issues can be answered by a comparison of the GDP

components before and after the revision. It turns out that in terms of

expenditures the largest difference of 5 percentage points (pp) before

and after the revision concerns gross investments growth. However, it

seems as if it is not the rate of investment expansion as such but the

deflator for gross investment that caused the large gap. This can be

seen by also comparing the revisions of nominal growth rates of the

various GDP expenditure components. In nominal terms, investment growth

revision (1.6 pp) is only second to the imports of services revisions

(1.8 pp) and hence also much smaller in size compared to the revision

of real investment data. |

||||

| The

answer to the second question is a bit more challenging. On the one

hand, seco preliminary data releases have been shown to be informative

for the eventual final data compiled by the FSO. Owed to this, most

independent researchers base their forecasts on seco's preliminary

estimates. On the other hand, however, as a consequence of using seco's

preliminary data, the deficits of this data carry over to the

alternative estimates making it very difficult to systematically

improve early bird forecasts. |

|||||

| robust indicator |

The estimates based on the «KOF

surprise indicator» are a case in point: Despite the strong

indication of very dynamic GDP growth throughout 2017, the actual

growth estimates remained underwhelming compared to the current state

of knowledge. The first growth estimate of 1.4 percent in February was

greatly influenced by economic figures as of December 2017 showing a

rather poor performance of the Swiss economy. It is not clear, however,

if a longer-term forecast that does not rely on seco's preliminary

estimates would have delivered better results. This question,

therefore, remains the subject of future research. |

||||

| Although large data revisions are not really desirable, they also have their benefits because they afford a test of the relevance of alternative business cycle evaluation methods. Again, the «KOF surprise indicator» yields some lessons. When the aforementioned gap opened, the question arose of whether or not it would eventually shrink. If it would, the indicator - once again - would have found support. The following figure does the test. | |||||

|

|||||

| too optimistic? |

The «KOF surprise

indicator» (in blue) compares considerably better to the

latest GDP estimates (in red) than to the preliminary values (in

black). As a consequence, the gap between indicator and GDP values as of 2017

narrowed significantly upon the new release. This reduction is shown as a

green area between old and new GDP data. Interestingly, a new gap with inverted roles is currently

opening. This new difference between preliminary GDP data for 2018 and

the «KOF surprise indicator» seems to imply that

seco's provisional 2018 data might indeed be too optimistic. Hence, according

to the «KOF surprise indicator» there is good

reason to believe that 2018 growth will break records but the final

figure may well be lower than it currently seems. |

||||

| bottom-up v top-down |

Finally, one may wonder what

seco could or should do in order to avoid severe revisions such as the

last one. For one, the summer 2018 revision cannot be attributed to

some important exogenous shock as it could be back in 2009/2010.

Therefore, the standard procedures for estimating GDP have to be

scrutinized. The standard is to calculate GDP bottom-up with the

various GDP components being approximated by several indicators. Other

suggestions notwithstanding, a potentially useful alteration of the

standard procedure could be to cross-check the bottom-up results with

top-down estimates. The «KOF surprise indicator»

handsomely testifies to the insights that can be gained by top-down methods. |

||||

| «home | |||||

| © Christian Müller 2018 | |||||

| Jacobs University Bremen | |||||

| www.s-e-i.ch | |||||